Arkansas tax officials won’t tweak payroll withholding guidelines again this year following another round of income tax cuts enacted by the General Assembly in last month’s special session.

According to Arkansas Advocate, that means taxpayers won’t see relief from the $150 tax credit on their paychecks; instead, they’ll see larger refunds or lower tax liability when they claim the credit on their taxes after filing season begins in January.

Scott Hardin, a spokesman for the Arkansas Department of Finance and Administration, said the agency would have to coordinate the withholding table changes with over 80,000 employers, and with only one quarter left in the current tax year, the agency will wait to adjust the tables with the new tax year in January.

Plus, tax officials already changed the withholding tables once this year, following income tax cuts enacted in the spring during the regular session.

“DFA will typically adjust the payroll withholding tables following an income tax cut or credit enacted by the Governor and General Assembly,” Hardin said. “However there have been previous income tax reductions that did not result in withholding changes. For the majority, the tables changed.”

That includes a withholding table change following a series of income tax cuts that included a similar $150 tax credit in August 2022 after a special session.

The state Legislature in last month’s special session created a one-time, nonrefundable tax credit for the ongoing tax year.

The full $150 credit will be available for taxpayers who earn up to $89,600 this year. It will be phased out for individuals up to $103,600 in annual income.

For example, an individual earning $100,000 this year would be eligible for a $40 credit.

Married couples filing jointly can claim a $300 credit up to $179,200. The credit phases out for couples earning up to $207,200.

Part-year residents and nonresident filers are not eligible for the credit.

The legislation also cut the top corporate and individual state income tax rates by three percentage points apiece, but those cuts don’t take effect until Jan. 1.

(From KTLO)

Giving Tuesday

Giving Tuesday

Blue Eye School District Recognizes Driver Who Helped Student Who Was Choking

Blue Eye School District Recognizes Driver Who Helped Student Who Was Choking

President Biden gives remarks for World AIDS Day

President Biden gives remarks for World AIDS Day

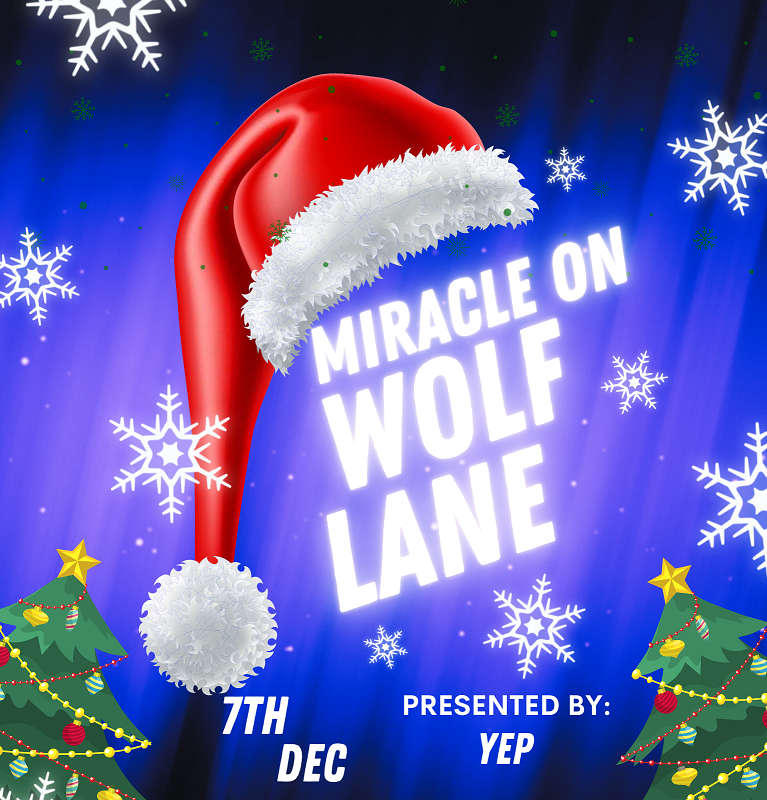

Miracle on Wolf Lane Scheduled for December 7

Miracle on Wolf Lane Scheduled for December 7