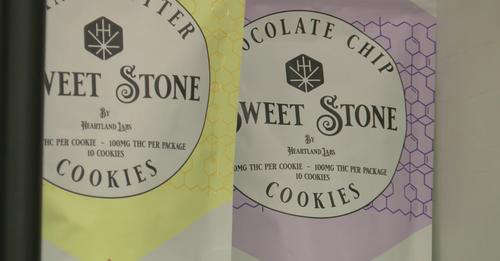

Sales Tax proposals for recreational marijuana were approved in last Tuesday's election.

Ozarks First Sydney Moran reports on the taxes passed in Christian County and the City of Ozark:

As recreational marijuana sales continue to grow, cities and counties have the option of adding a sales tax to purchases — something voters approved in Ozark and Christian County Tuesday.

Voters approved additional three percent sales taxes on recreational marijuana purchases in both Christian County and the city of Ozark. Now dispensaries are wondering what to charge customers.

“I think this is a defensive tax is why I consider it something that is going to help protect our budget,” Christian County Presiding Commissioner Lynn Morris said.

Morris says it is still up in the air how the funds generated by the tax will be spent. Originally, he says counties and cities were told they could not stack the taxes. But, he says the Department of Revenue changed that, allowing places like Ozark and Christian County to each impose separate three percent sales taxes. With the six percent state sales tax, customers could see at least a 12 percent tax on recreational purchases.

“I really think this is is going to be a good thing for the county,” Morris said. “I don’t want it to hurt any business, but I think they’re going to be okay.”

For dispensaries like Flora Farms, it’s been a busy few months since recreational weed became legal. Its dispensary in Ozark opened in December.

“It’s a great location, a great community,” Flora Farms President Mark Hendren said. “The business there has been as good as any other dispensary we’ve seen. We don’t believe, even at those [tax] numbers, that it’ll significantly impact business. The average purchase at Flora Farms business, it turns out, is less than $100. So although it is money and everybody’s got to pay it, we all have to watch our money. It’s still not a large amount of money.”

For some recreational users, the tax is just a number.

“It seems like a little bit high,” Seth said. “If it gets revenue for the state, we can use it for good things. I mean, that’s all that really matters at the end of the day.”

Flora Farms said there are still other options with a lower tax.

“It might be worth it especially in some counties, for people to go back and take another look at the requirements for a medical card,” Hendren. “The taxes lower and the allotment is higher and you probably get a little faster service in some of the dispensaries.”.

Morris said the additional taxes could start in October.

Branson Parks & Recreation Announces Two Family Bonding Events on February 8th

Branson Parks & Recreation Announces Two Family Bonding Events on February 8th

City of Branson declares success in Lodging Safety Initiative

City of Branson declares success in Lodging Safety Initiative